Enhanced Capital Allowance

A brief guide to saving you an extra 19%* on your LED projects

This guide has been produced to provide you with a quick overview into the Enhanced Capital Allowance (ECA) and how easy it is to claim back a percentage of your capital project spend on luminaires.

What is Enhanced Capital Allowance?

This is part of the Government’s programme to manage climate change, to and try and achieve the commitment of the Kyoto Agreement to reduce the carbon emissions.

How does it achieve this?

The scheme encourages businesses to invest in energy saving technology and reduce their carbon emissions. It is seen as a straightforward way for a business to improve its cash flow through accelerated tax relief.

Who Can Claim?

Companies that make a profit and pay corporation tax can claim back the % of the corporation tax they pay, on the project total. when using compliant products. For example, if the company pays 19% corporation tax but spends £10k on compliant products they can claim back 19% of the total spend = £1,900 saved.

My Company is currently making a loss – can I Claim?

If the company is loss making, they can realise the tax benefit of the investment by surrendering losses, attributed to the ECA complaint products, in return for a cash payment from the Government.

The amount payable to any company claiming payable ECAs will be expressed as 19% of the loss surrendered. For example, if the £10,000 loss is surrendered the company will receive £1,900 back from the Government.

Please note: payable ECAs are capped in this circumstance and the maximum credit that can be claimed is limited to the total of the companies PAYE and National Insurance contributions for the year the claim is made if greater than £250,000.

What Product categories are covered under the ECA Scheme?

- Amenity, accent and display lighting

- General interior lighting

- Exterior area lighting

- Exterior floodlighting

Please refer to index at end of guide for a detailed description of the areas covered under the ECA scheme.

What products meet the Criteria?

High Efficiency Lighting Units – the criteria

White Light Emitting Diode Units.

These units are products that consist of one or more white LED’s, incorporated into a lighting fitting (or luminaire) including any control gear. The ECA scheme aims to encourage the purchase of higher efficiency products.

The product must meet the following criteria to comply.

In addition the products must meet the following criteria to comply.

The Luminaire must be CE marked.

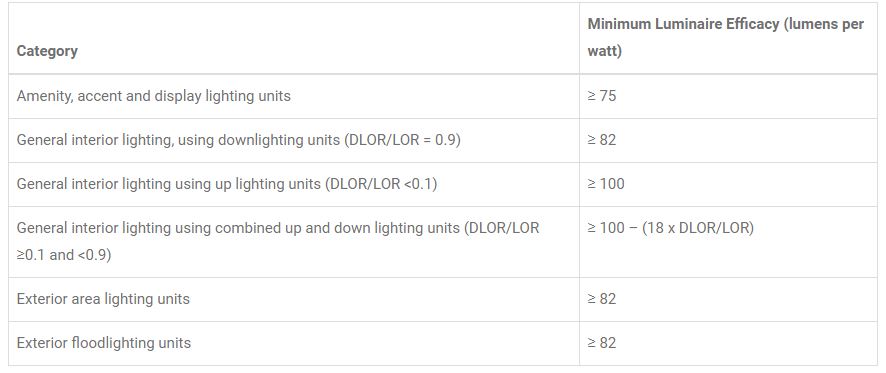

- A luminaire efficacy that is greater than or equal to the thresholds detailed in the previous table when tested after 100 hours of continuous operation

- A power factor that is great than or equal to 0.7 at all light levels of product light output

In addition:

- General lighting units installed must comply with the glare and angular exclusion zone recommendations in paragraph 94 of HSG 38 (1997)

- Fluorescent and compact fluorescent lamps in all categories and all lamps used in amenity, accent and display lighting units must have a colour rendering index of at least Ra80. All other lamps must have a colour rendering index of at least Ra20.

- Where products include compact fluorescent, they must not incorporate the control gear in the base of the lamp

- Where products incorporate high intensity discharge lamps rated below 200w, they must use electronic control gear.

- All lamps and control gear must comply with relevant performance standards – BS EN 60901:1996; BS EN 60081: 1998; BS EN 60929:2011 or by ENEC marked

- Where products include light emitting diodes (LED) they must comply with the relevant parts of the white light emitting diode criteria.

Scope of Claim

Expenditure on the provision of plant and machinery can include not only the actual cost of buying the equipment, but other direct costs, such as transport of the equipment to site and some of the direct costs of installation. Clarity on the eligibility of direct costs is available from HMRC.

How do I Claim?

Claims must be made in the accounting period the item was purchased to claim the full value – claims are made via HMRC;

- Self-assessment tax return if you are a sole trader

- Partnership tax return if you’re a partner

- Company tax return if you a limited company – there is a requirement to include a separate capital allowances calculation.

Further information:

Please visit the following sites for further information;www. Decc.gov.uk

www.HMRC.gov.ukThe Light Solution can advise which products are ECA complaint and provide the documentation required for making the claim – please contact us for further information.Please note all information is correct at time of publishing, this guide has been produced to give

We strongly advise that confirmation the product is eligible for ECA prior to making your purchase and advise at time of order you intend to apply under the scheme so the correct documentation can be provided.